Machine Vision Market Report & Overview:

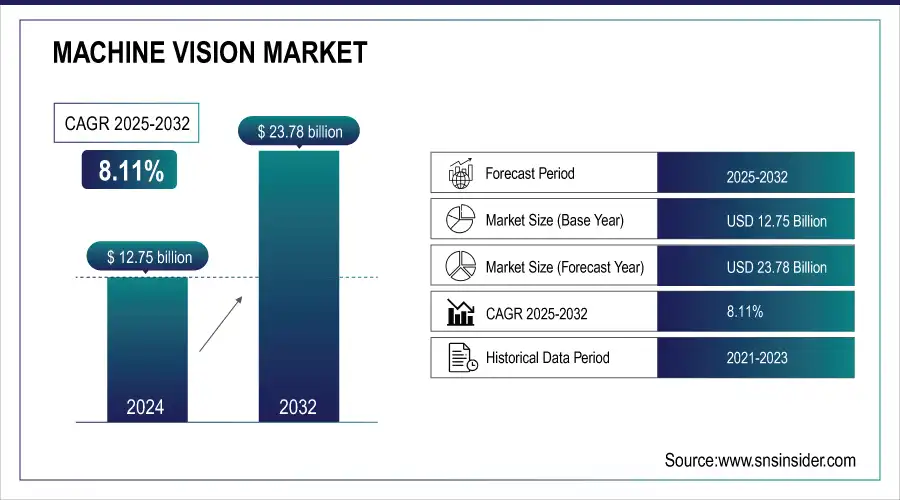

The Machine Vision Market Size was valued at USD 13.78 billion in 2025E and is expected to reach USD 25.72 billion by 2033 and grow at a CAGR of 8.11% over the forecast period 2026-2033.

Get more information on Machine Vision Market - Request Sample Report

The machine vision market is rapidly expanding due to the increasing adoption of automation across industries such as manufacturing, automotive, electronics, and food & beverage. Driven by advancements in AI, machine vision enhances operational efficiency, quality control, and accuracy, while also reducing reliance on human labor. In 2023, machine vision systems equipped with AI-driven cameras have achieved defect recognition rates surpassing 99%, significantly improving product quality and minimizing defects. These systems are also being integrated into robotics for pick-and-place applications, enhancing production line efficiency by up to 20%. The technology’s role extends beyond factory settings, impacting industries like logistics and agriculture. In warehouses, machine vision can reduce sorting times by 50%, streamlining operations.

Machine Vision Market Size and Forecast:

-

Market Size in 2025E: USD 13.78 Billion

-

Market Size by 2033: USD 25.72 Billion

-

CAGR: 8.11% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Machine Vision Market Highlights:

-

Growing adoption of automation in manufacturing is driving demand for machine vision systems to improve quality control and efficiency.

-

Integration of AI and deep learning with machine vision enhances defect detection, predictive maintenance, and real-time analytics capabilities.

-

Increasing use in robotics and autonomous systems is expanding applications across automotive, electronics, and logistics industries.

-

Miniaturization and cost reduction of cameras and sensors are enabling deployment in small-scale and embedded systems.

-

Expansion of industrial IoT (IIoT) is creating opportunities for connected machine vision solutions and data-driven decision making.

Machine Vision Market Drivers:

- The Role of Machine Vision in Revolutionizing Security and Surveillance

The growing demand for improved security systems is rapidly accelerating the adoption of machine vision technology, particularly in commercial, industrial, and government sectors. With AI integration, machine vision systems are pivotal in applications such as facial recognition, object tracking, and intrusion detection, providing faster, more accurate threat identification and response. In countries like China, over 170 million CCTV cameras are already operational, with plans for an additional 400 million, reflecting the widespread global adoption of AI-powered surveillance. In Hyderabad, India, around 30 CCTV cameras per 1,000 people were recorded in 2020, underscoring the trend toward smarter, automated systems. AI enhances the efficiency of these systems by enabling real-time detection of unusual behavior and unauthorized access, minimizing human oversight while optimizing resources. With the rise of complex security challenges, the need for advanced surveillance systems that can autonomously identify threats and track behavioral patterns becomes crucial. These innovations are set to transform the security landscape globally, advancing the role of machine vision in law enforcement, border control, and safety monitoring.

Machine Vision Market Restraints:

- Data privacy and security concerns, especially in facial recognition, pose significant challenges to machine vision market growth, particularly in regulated sectors.

Data privacy and security concerns remain significant barriers to the growth of the machine vision market, particularly in applications such as facial recognition and surveillance. The ability of machine vision systems to capture and analyze personal data raises concerns about potential misuse and violations of privacy rights create challenges in adopting machine vision technologies. Facial recognition systems, for example, have been criticized for lacking transparency and accountability in handling sensitive data, which can deter businesses from integrating these solutions into their operations. Moreover, the fear of data breaches, unauthorized access, and misuse of sensitive information heightens the reluctance to embrace machine vision. This is especially true in countries with strict data privacy laws, where penalties for non-compliance can be severe. The ethical implications of using machine vision for surveillance also fuel concerns among consumers and advocacy groups, potentially leading to regulatory roadblocks and slowing down market adoption. Therefore, addressing these data privacy concerns with transparent and secure systems is crucial for the widespread acceptance of machine vision technology in security, surveillance, and other sensitive applications.

Machine Vision Market Segmentation Analysis:

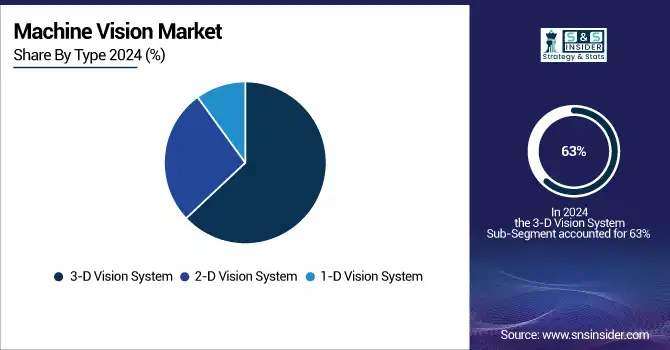

By Type, 3D Vision Systems Dominate Machine Vision Market in 2025

In 2025, the 3D Vision System segment dominates the machine vision market, accounting for approximately 63% of the market share. This growth is driven by the increasing adoption of 3D imaging technologies across industries such as manufacturing, automotive, and healthcare. 3D vision systems provide enhanced precision and depth perception, making them essential for applications like quality inspection, robotic guidance, and object recognition. Their ability to capture intricate details in real time boosts efficiency and accuracy, positioning 3D vision systems as a critical component in advanced automation and smart manufacturing solutions.

By Scan System, Area Scan Segment Leads Machine Vision Market in 2025

In 2025, the Area Scan segment dominates the machine vision market, capturing approximately 69% of the market share. This segment's leadership stems from its versatility in capturing high-resolution images in two dimensions, making it ideal for applications like surface inspection, pattern recognition, and object measurement. Area scan systems are widely used in industries such as electronics, packaging, and food processing, where detailed image analysis is critical. Their ability to capture a single, comprehensive image in one shot ensures efficiency and precision, contributing to their widespread adoption.

Machine Vision Market Regional Analysis:

North America Dominates Machine Vision Market in 2025

North America is the dominant region in the Machine Vision Market, holding an estimated 38% market share in 2025. This leadership is driven by early adoption of automation technologies, advanced industrial infrastructure, and high investments in robotics and AI, which accelerate machine vision deployment and integration across manufacturing and automotive sectors.

Need any customization research on Machine Vision Market - Enquiry Now

United States Leads North America’s Machine Vision Market

The United States dominates the region due to its mature manufacturing ecosystem, strong R&D capabilities, and high adoption of Industry 4.0 technologies. Leading automotive, electronics, and semiconductor companies integrate machine vision systems for quality inspection, robotic guidance, and defect detection. Government initiatives supporting automation, innovation hubs, and collaborations between industry and academia further drive market growth. The U.S. remains the central hub for advanced machine vision solutions, setting technology standards for North America.

Asia Pacific is the Fastest-Growing Region in Machine Vision Market in 2025

Asia Pacific is the fastest-growing region in the Machine Vision Market, with an estimated CAGR of 27% during 2025. Growth is fueled by rapid industrialization, adoption of smart manufacturing, and rising labor costs, which accelerate the deployment of machine vision systems.

China Leads Machine Vision Market Growth in Asia Pacific

China dominates due to its massive manufacturing base, especially in automotive, electronics, and consumer goods. Government initiatives promoting smart factories and AI adoption boost machine vision usage. Major manufacturers implement these systems for process optimization, quality control, and robotics guidance. Investments in industrial automation, coupled with the rising need for precision and efficiency, drive adoption. China’s technology innovation hubs and export-focused manufacturing further establish it as the central hub for machine vision solutions in Asia Pacific.

Europe Machine Vision Market Insights, 2025

Europe accounts for a significant share of the Machine Vision Market, driven by automotive, electronics, and industrial automation sectors. Germany’s high adoption of industrial robots and advanced automation accelerates machine vision integration, improving productivity and quality. Germany dominates due to its leading automotive and electronics industries, robust Industry 4.0 adoption, and strong R&D ecosystem. Companies implement machine vision for defect detection, quality assurance, and automated assembly processes. Government initiatives, technology clusters, and innovation investments further enhance adoption, making Germany the central hub for machine vision in Europe.

Middle East & Africa and Latin America Machine Vision Market Insights, 2025

The Machine Vision Market in the Middle East & Africa and Latin America is emerging, driven by industrial modernization and automation in key manufacturing sectors. Countries like Brazil, Mexico, UAE, and Saudi Arabia are increasingly investing in smart manufacturing technologies to improve productivity and reduce defects. Adoption is rising in automotive, electronics, and food processing industries. While these regions are behind North America, Europe, and Asia Pacific, gradual uptake of machine vision solutions is expected as industrial infrastructure develops and automation initiatives expand.

Machine Vision Market Competitive Landscape:

Cognex Corporation

Cognex Corporation is a U.S.-based leader in machine vision solutions, specializing in 3D vision systems, barcode readers, and inspection cameras. With decades of experience, the company develops highly accurate, reliable, and scalable vision solutions for industrial automation, quality inspection, and robotic guidance. Cognex operates globally, providing software, hardware, and support services tailored to manufacturing, automotive, electronics, and logistics sectors. Its role in the machine vision market is pivotal, enabling businesses to enhance operational efficiency, reduce defects, and optimize production processes.

- In 2024, Cognex launched advanced In-Sight 3D cameras with AI-driven inspection capabilities, improving real-time defect detection and process automation.

Basler AG

Basler AG is a Germany-based leader in industrial cameras and embedded vision systems, specializing in area scan and line scan cameras. The company delivers high-resolution imaging solutions for automation, quality control, and logistics, ensuring precise and reliable visual data capture. Basler’s global operations include design, production, and distribution of camera systems for diverse industries, enabling enhanced efficiency and accurate machine vision applications. Its contribution to the market lies in providing versatile imaging solutions that support AI integration, robotic guidance, and inspection systems.

- In 2024, Basler introduced a new line of embedded vision cameras with improved speed and resolution for automated manufacturing environments.

Omron Corporation

Omron Corporation, headquartered in Japan, is a key player in industrial automation and machine vision systems, offering vision sensors, cameras, and factory automation components. The company integrates advanced AI and optical technologies to support quality inspection, robotic guidance, and process optimization. Omron’s solutions enhance operational efficiency, reduce errors, and improve production reliability across manufacturing and automotive sectors. Its role in the machine vision market is critical, as it combines sensor intelligence with automation expertise to deliver scalable, reliable, and innovative vision solutions worldwide.

- In 2024, Omron launched AI-powered smart cameras that enhance defect detection and automated sorting in high-speed production lines.

Keyence Corporation

Keyence Corporation is a Japan-based leader in smart sensors, 3D vision systems, and laser displacement sensors. The company develops innovative machine vision solutions for automated inspection, robotic guidance, and quality control across industries such as automotive, electronics, and pharmaceuticals. Keyence combines hardware, software, and AI-powered analytics to provide highly accurate, real-time visual data for manufacturing and industrial automation. Its role in the machine vision market is significant, supporting improved operational efficiency, defect reduction, and production optimization.

- In 2024, Keyence unveiled new 3D vision systems integrating AI analytics for precise inspection and enhanced automated assembly processes.

Machine Vision Market Key Players:

-

Cognex Corporation

-

Basler AG

-

Omron Corporation

-

Keyence Corporation

-

National Instruments

-

Sony Corporation

-

Teledyne Technologies

-

Texas Instruments

-

ViDi Systems SA

-

Sick AG

-

KUKA Robotics

-

LMI Technologies

-

MVTec Software GmbH

-

FLIR Systems

-

Microchip Technology Inc.

-

Advanced Illumination

-

SensoPart Industriesensorik

-

Allied Vision Technologies

-

Universal Robots

-

Intel Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 13.78 Billion |

| Market Size by 2033 | USD 25.72 Billion |

| CAGR | CAGR of 8.11% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (1-D Vision System, 2-D Vision System, 3-D Vision System) • By Scan System (Area Scan, Line Scan) • By Industry (Semiconductor, Healthcare, Automotive, Manufacturing, Other (Retail, etc.)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cognex Corporation, Basler AG, Omron Corporation, Keyence Corporation, National Instruments, Sony Corporation, Teledyne Technologies, Texas Instruments, ViDi Systems SA, Sick AG, KUKA Robotics, LMI Technologies, MVTec Software GmbH, FLIR Systems, Microchip Technology Inc., Advanced Illumination, SensoPart Industriesensorik, Allied Vision Technologies, Universal Robots, Intel Corporation. |